So what does Nile Rogers (2nd from left in the picture, but you know I’m a bassist and Stick player so I have to have Bernard in there too) have to do with your startup? To be honest, little apart from a measurement in your self belief and the belief in your own venture. That though counts for an awful lot.

The assumption that every startup is going to go through the same auto pilot cycle of idea > some money (public or otherwise) > accelerator > pivot > rinse and repeat is so well documented and overly adopted. You can Lean Startup it, Business Model Canvas it or Personal MBA it or a mixture of. Bootstrappers of world, you’re not forgotten either.

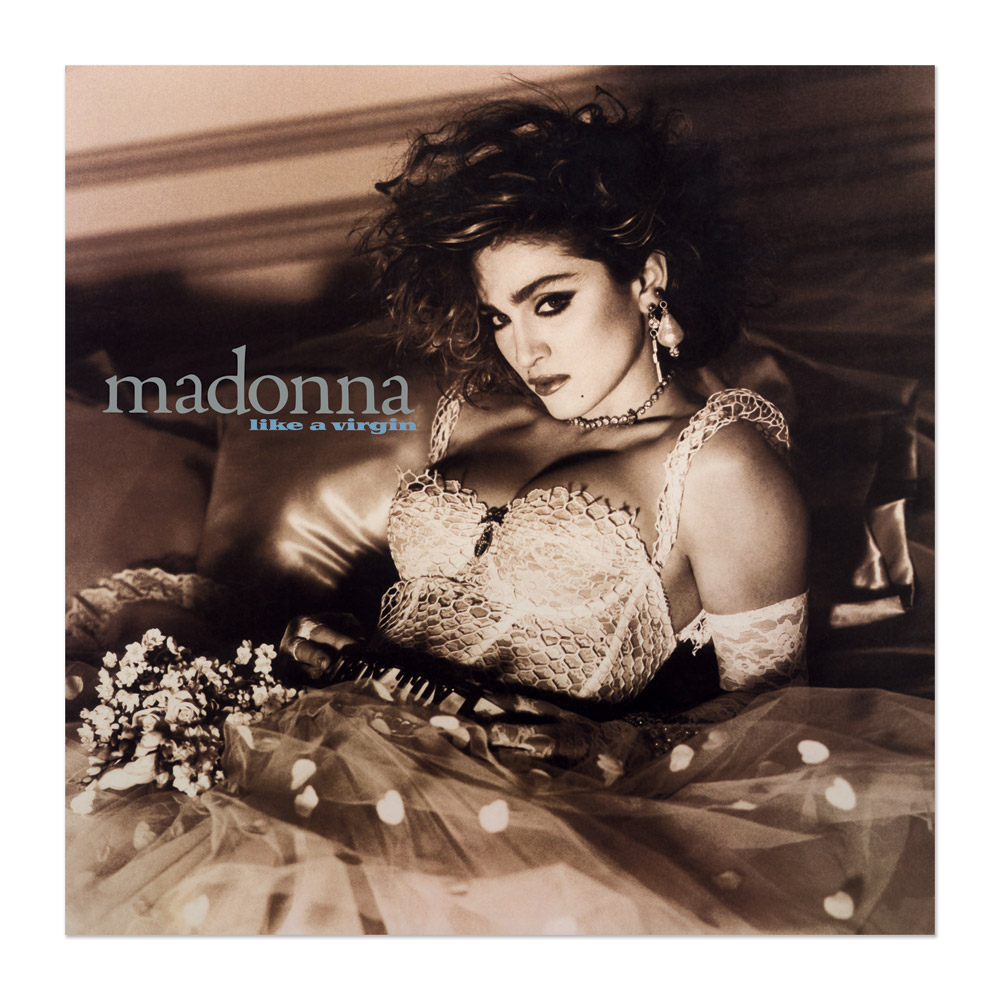

That Difficult Second Album

Madonna’s first album was, and is, a classic. Make no bones about it Borderline and Lucky Star are pretty much perfect pop songs. Even so sales after the first year were in the 750,000 mark and Nile Rodgers was brought on to produce the next one, you might have heard of it….

The self belief that Nile had in Madonna as an artist made him so sure of the way he wanted to do things. He was happy to for go his advance (in startup land, let’s call it funding). Now the advance covers you while product is being made and is then essentially paid back against revenues of the product until a certain amount is reached.

The idea that Madonna could sell five to six million copies of Like A Virgin easily (this wasn’t risk analysis, I believe it was sheer self belief, “I placed a bet on myself” were his words) that he was willing to not take an advance but be paid a higher royalty from the sale of copy number 1 onwards.

It paid off, 21 million copies sold and a higher royalty from copy 1.

Bet On Your Own Startup?

I believe anyone who can stand in front of a pitch panel, investor or accelerator and say, “We’re gonna be the next {x} of {y}” or “We’re gonna disrupt {X} industry” are usually great story tellers, able to convince a set of folk who hold money (their own or otherwise) to hand it over to the story teller. It’s little to do with belief at the time.

Having the belief to get actual customers and make revenue is a different matter. The story telling will only go so far.

The Challenge

So here’s the question, could you look in the mirror and say, “I’m going to bet £10/£50/£100* that my venture is going to make £100,000/£750,000/£1,000,000,000* profit in 1/3/5/10 years*”? Even better find a way to make that bet concrete (I know there are all reasons not to bet, if you’re uncomfortable with it I understand, you’ll need to find another way). What could you forgo in the short term to increase the upside when the venture is successful?

Even better, announce your intention. There’s nothing exposure to public ridicule to galvanise the attention. If you fail then that’s fine, it happens, been there plenty of times myself.

For me personally I don’t take funding, simple as that, build it then find customers. I choose my mentors based on the industry, not the locality. And I’m in for the long play, not short term gains. There’s timing in everything, you might think you’re ready but the rest of the world may not.

* – Delete as applicable

Leave a comment